Confused between XIRR and CAGR? Learn which method is best for SIP and lump sum investments, with practical examples to understand your mutual fund returns accurately.

When it comes to evaluating your investment returns, especially in mutual funds, two key terms often create confusion: CAGR and XIRR. Both are used to calculate returns, but they serve very different purposes depending on how you invest—lump sum or SIP (Systematic Investment Plan).

Let’s break down what they mean, when to use each, and why using the right metric is crucial to understanding your true investment performance.

🔹 What is CAGR?

CAGR (Compound Annual Growth Rate) tells you the average annual return your investment has earned over a specific period, assuming your investment grew at a steady rate every year.

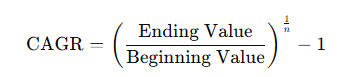

📌 Formula:

Where n is the number of years.

✅ Best for:

- Lump sum investments

- Performance of an asset over time without multiple cash flows

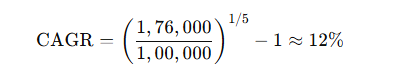

🧮 Example:

Suppose you invested ₹1,00,000 in a mutual fund 5 years ago. Today it’s worth ₹1,76,000.

This means your investment grew at an average rate of 12% per year.

🔹 What is XIRR?

XIRR (Extended Internal Rate of Return) is an advanced formula that calculates the annualized return considering multiple cash flows (investments and redemptions) made at different times. It is especially useful for SIPs and irregular investment patterns.

It gives a realistic picture of your return because it accounts for:

- Date and amount of every SIP installment

- Partial withdrawals or top-ups

✅ Best for:

- SIP investments

- Anytime multiple transactions are involved

🧮 Example:

Let’s say you invest ₹5,000 every month via SIP for 3 years and now your total investment of ₹1,80,000 is worth ₹2,25,000.

Since the money was not invested all at once, CAGR can’t reflect true performance. You need XIRR to calculate accurate annual returns. Most mutual fund platforms and Excel provide XIRR calculators.

In Excel, use:

sqlCopyEdit=XIRR(values, dates)

💡 Why Using the Right Metric Matters

| Scenario | Use CAGR? | Use XIRR? |

|---|---|---|

| One-time lump sum | ✅ | ❌ |

| SIP or multiple deposits | ❌ | ✅ |

| Irregular cash flows | ❌ | ✅ |

| Analyzing fund NAV only | ✅ | ❌ |

Using CAGR for SIPs can significantly understate your returns, while using XIRR for lump sum may complicate a simple situation.

🧠 Common Misconceptions

- “CAGR is always better because it’s simpler.”

➤ Wrong. Simpler doesn’t mean accurate for SIPs. - “XIRR is only for professionals.”

➤ False. Anyone with a SIP or staggered investment plan must use XIRR to know the real returns. - “Both give similar results.”

➤ Only if all money was invested on the same day—rare in reality.

🛠️ Tools to Calculate CAGR and XIRR

| Tool/Platform | Supports CAGR | Supports XIRR |

|---|---|---|

| Excel/Google Sheets | ✅ | ✅ |

| Zerodha Coin | ✅ | ✅ |

| Groww, Kuvera, Paytm Money | ✅ | ✅ |

| AMFI website | ✅ | ❌ |

✅ Final Takeaways

- Use CAGR for lump sum investments.

- Use XIRR for SIPs or any investment with multiple transactions.

- Don’t compare two mutual funds using the wrong return metric.

Smart investors don’t just look at returns—they understand how they’re calculated.

📝 Author’s Note:

If you are planning your investments or struggling to interpret your fund’s return figures, don’t hesitate to connect with a SEBI-registered adviser. The right understanding today can help you build wealth, save tax, and stay financially secure tomorrow.

📢 Related Articles:

- Best Mutual Funds for SIP in 2025

- How to Choose Between SIP and Lump Sum

- Income Tax Benefits of Investing in ELSS Funds